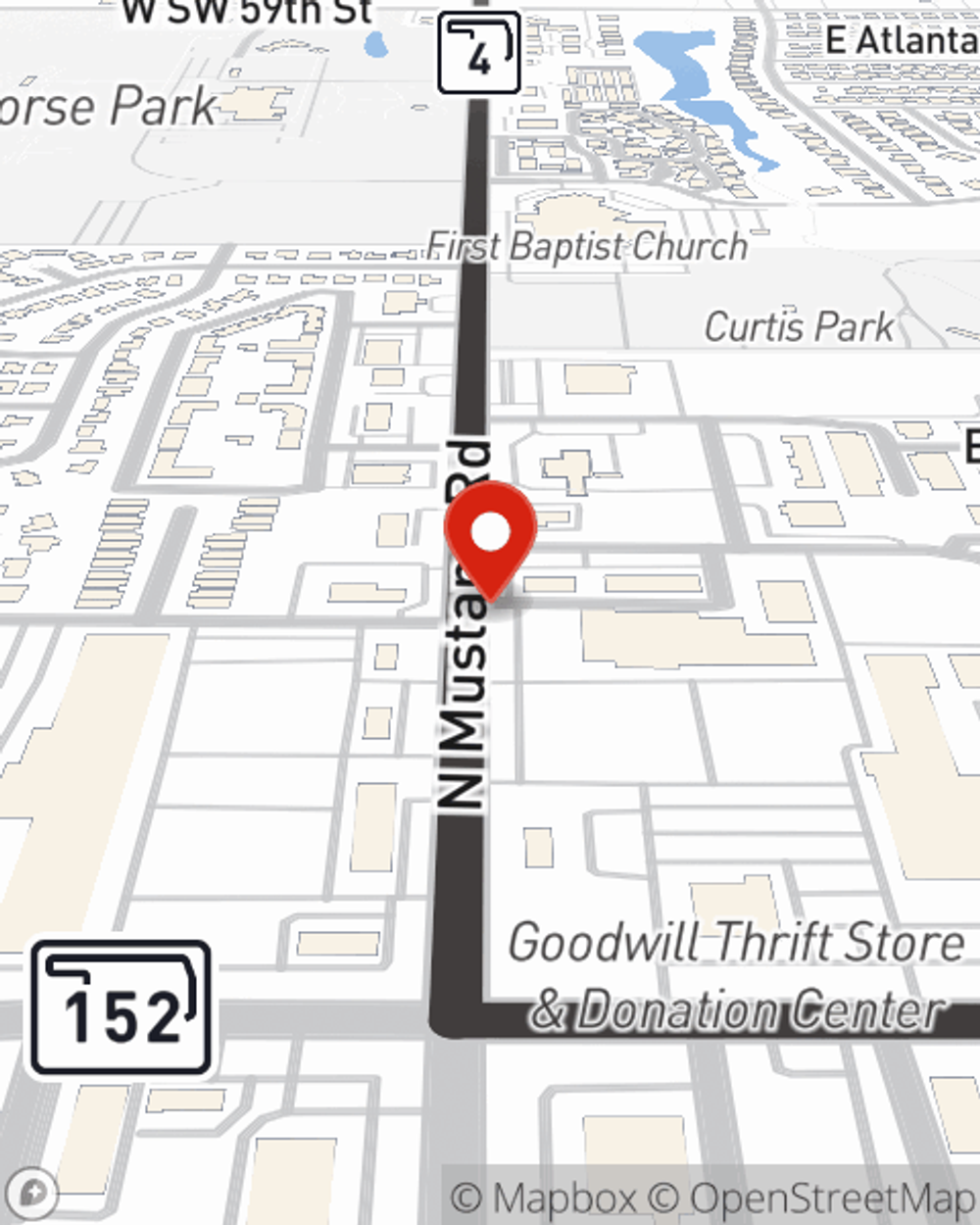

Business Insurance in and around MUSTANG

One of the top small business insurance companies in MUSTANG, and beyond.

Helping insure small businesses since 1935

- Tuttle

- Moore

- Oklahoma City

- Yukon

- Oklahoma County

- Grady County

- Cleveland County

- Canadian County

- El Reno

- Minco

Coverage With State Farm Can Help Your Small Business.

Preparation is key for when the unexpected happens on your business's property like a customer slipping and falling.

One of the top small business insurance companies in MUSTANG, and beyond.

Helping insure small businesses since 1935

Cover Your Business Assets

With options like errors and omissions liability, worker's compensation for your employees, extra liability, and more, having quality insurance can help you and your small business be prepared. State Farm agent Stephanie Barnes is here to help you customize your policy and can assist you in submitting a claim when the unexpected does occur.

So, take the responsible next step for your business and visit with State Farm agent Stephanie Barnes to discover your small business insurance options!

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Stephanie Barnes

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.